HEALTH INSURANCE CLAIM REJECTED Part:2

- Mon Dec 23 18:30:00 UTC 2024

- In Mentoring and Guidance by Aparna Bose

THE ULTIMATE GUIDE TO TACKLE REJECTION- (PART-2)

If a policyholder experiences an accident or requires hospitalization due to a medical emergency, they can submit a claim request to their insurance provider. The insurer will evaluate the claim and determine its acceptance or rejection in accordance with the policy's terms and conditions. This process defines what a health insurance claim entails. When a claim is approved, the insurance company covers the hospital expenses, alleviating the financial burden on the policyholder.

While we've addressed many aspects of health insurance claim rejections in Part-1, there are still a few points we would like to highlight and expand upon to enhance the informativeness of our blog.

FORGOT TO DECLARE YOUR HEALTH CONDITION WHILE BUYING INSURANCE? HERE’S WHAT YOU CAN DO

Imagine you've been experiencing troubling symptoms for months but hesitate to see a doctor due to lack of health insurance. After some research, you purchase an affordable individual or family health plan. However, you omit details about your symptoms on the application, fearing higher premiums or denial. Later, you receive a costly diagnosis, only to find that your policy may not cover treatment due to the undisclosed information.

While not revealing pre-existing conditions can be a serious issue, it’s not the end of the world. Understanding your options and taking proactive steps can help mitigate the consequences.

This blog will walk you through on how to add health conditions to your insurance policy:

After you buy a health insurance policy, there’s a FREE-LOOK PERIOD during which you can cancel, modify or correct any details in the policy. So, if you have not declared some information about your health while purchasing the policy, you can do it during this period, which is generally 15 days to 30 days from the date of purchase. The insurer will underwrite the policy as per the guidelines.

If the free-look period is over, you can still disclose your health condition at the time of policy renewal. However, it is the insurance provider’s discretion to accept the new disclosure, continue the coverage, charge a high premium, exclude the medical condition or even cancel the health insurance policy.

You can buy a new health insurance policy or switch to another health insurance provider and honestly declare your medical conditions while purchasing a new plan to get coverage under pre-existing disease health insurance.

However, if you have been paying premiums for 8 continuous years and any pre-existing disease in the list of pre-existing diseases in health insurance is discovered after this period, the insurance provider cannot cancel the policy.

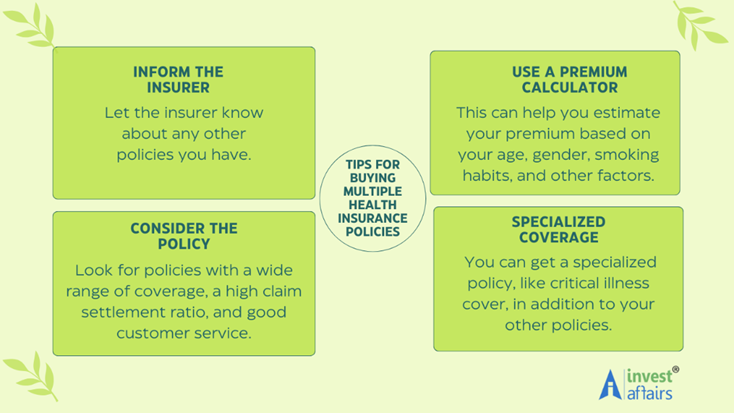

CAN WE PURCHASE MORE THAN ONE POLICY?

Yes, you can purchase more than one medical insurance policy. In fact, it can be a good idea for people who have a disease, as insurance companies may consider them high-risk and offer limited coverage.

Here are some benefits of having multiple health insurance policies:

- Financial safety net: Multiple policies can provide a financial safety net in case of a claim rejection or if you need to use medical treatment more than once.

- Lower premiums: Buying multiple policies can lower your overall premium costs.

When you have multiple policies, you can use them for a single claim, but you can't claim the same expenses from more than one insurer. For example, if your claim with Company A doesn't cover the full bill, you can file a claim with Company B for the remaining balance.

*Premium calculators can be accessed on the website of the concerned insurer or you may ask your financial experts to guide you on this.

Accidents, sickness, and other health ailments are never pre-planned. So, during a medical emergency, the rising medical costs can be a burden on the patient or his family. However, a comprehensive health insurance plan can help you meet your medical expenses and avoid financial woes. Here are some of the benefits of having a health insurance policy :

Benefits of Health Insurance

- You will receive cashless treatment for admissible ailments if you are in a network hospital and thus save yourself from taking money out of your account for the treatment.

- Getting a health insurance policy early in your life can offer a plethora of benefits at lower premiums.

- The health insurance plan can help you avail high cost treatments and skip paying the expensive bills from your own pocket.

- Having health insurance can sometimes also cover preventive health measures like health checkups and screenings.

- Cumulative Bonus (CB) is another added advantage if you don’t claim your insurance for some amount of time whereby your coverage amount is increased. In addition to )CB_, if you are a long time policyholder, you might also be eligible for a long term policy discount. You can talk to your insurance provider for more details on this.

- Health insurance is a great tax saving instrument too. With a comprehensive health insurance policy, you can save up to Rs. 75,000 in tax annually, under section 80D with health insurance plans. A win-win situation indeed!

P.S. Kindly regard this write-up as work in progress. Will be updated as and when required.

Disclaimer: The data and information has been sourced from various domains available to the public. We have taken utmost care to represent the same as factually as has been made available. Please do not make any decisions based on our blogpost. Kindly check the data & information independently. For further guidance on finance and investment please reach out to our experts at Investaffairs.

If you have any Personal Finance query, do write to us

Categories

Recent Posts